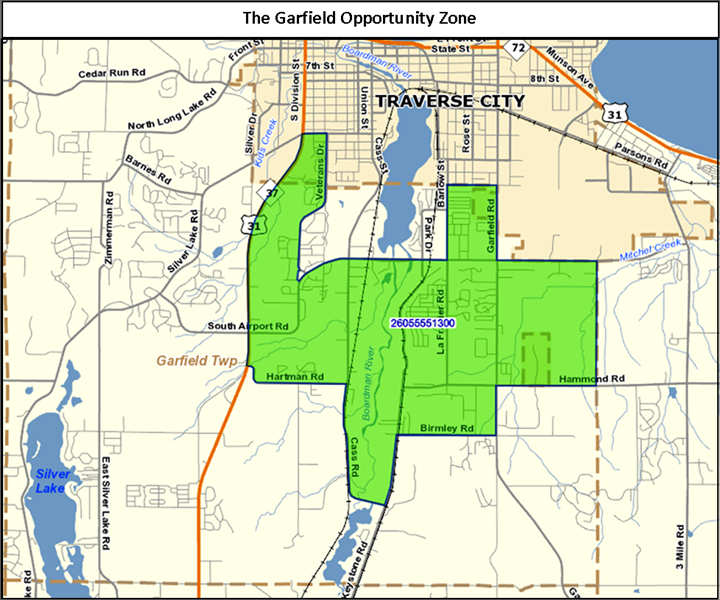

Garfield Opportunity Zone

The Garfield Opportunity Zone is a United States Census Tract generally composed of economically distressed neighborhoods that qualify for the Opportunity Zone program, according to criteria outlined in the United States Tax Cuts and Jobs Act of 2017. The Opportunity Zone program was created to revitalize these neighborhoods using private investments rather than taxpayer dollars. To stimulate private participation in the Opportunity Zone program, taxpayers who invest in the Opportunity Zone are eligible to benefit from capital gains tax incentives available exclusively through the program.

To access these tax benefits, investors must invest in the Opportunity Zone specifically through Opportunity Funds. A qualified Opportunity Fund is a US partnership or corporation that intends to invest at least 90% of its holdings in one or more qualified Opportunity Zones.

In exchange for following the rules of the Opportunity Zone program and investing in the Opportunity Zone through Opportunity Funds, investors can receive substantial capital gain tax incentives immediately and over the long term.